For Businesses.

Companies face real challenges when undertaking debt recovery. Most don’t have the time, skillsets or processes to ensure smooth, positive results. We provide a holistic approach that overcomes these hurdles for enhanced financial outcomes, brand protection and regulatory risk mitigation, all with a commitment to socially responsible processes.

Our service.

By buying your company’s bad debt for an agreed percentage, your business gains financial certainty and immediate payment. We integrate seamlessly into your processes and can take a long-term view to recover that debt. It’s fairer for customers struggling to repay debt and means you’ve chosen a partner dedicated to protecting your brand’s reputation while making bad debt good.

Four steps

to faster, fairer

debt recovery.

Transforming the way bad debt’s handled starts with how we engage with your business. A simple process that identifies all the key information enabling us to deliver the best value realisation.

-

1

Explore

Simply fill out this form to set up a no-obligation 10-minute exploration call with our team. We’ll identify ways we can support you including customer rehabilitation, risk management and financial realisation. Whether selling bad debt is an existing practice or you’ve never sold before, we seamlessly fit in with your credit processes to ensure positive transformation of your systems and at-risk customers.

-

2

Assess

By now we’ll have developed a deeper understanding of what’s important to your business, the nature of your credit processes and the scope of the debt sale opportunity. Subsequently, we’ll share our purchase eligibility criteria and key financial terms. We’ll then explain how we’ll integrate seamlessly into your systems and processes.

-

3

Secure

With our financial proposal agreed, we’ll share our standard terms and conditions for approval. Concurrently, our onboarding team will help you gather the required information. We have resources on hand to help if needed. Finally, files are assigned, customers are notified, and you receive immediate payment.

-

4

Expand

With financial certainty and brand protection assured, you can focus on other aspects of your business. DebtManagers will always treat your customers with empathy, respect and trust, allowing you to better achieve your objectives and join us as we create a fairer financial world.

Our customers matter to us

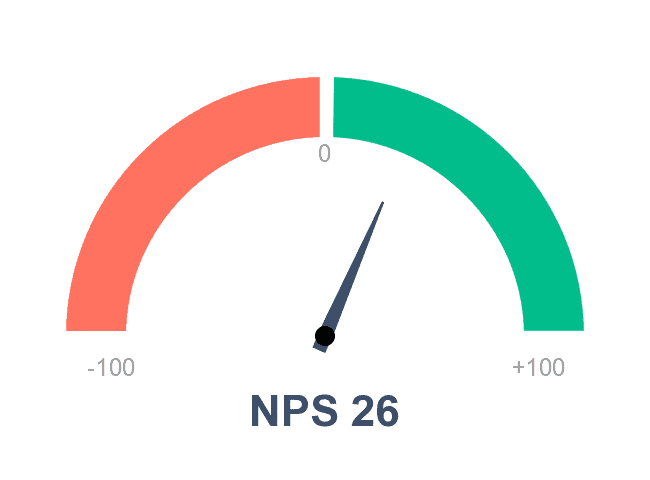

What is NPS

NPS is an internationally recognised way to measure our customer’s experience as we journey them through a financial rehabilitation path. Customers are given chances to offer us feedback at multiple stages and this is distilled into policies and procedures that are friendly, effective and, most of all, fair.

Our results

What customers say

Sarah A. 23-03-2023

“He was very pleasant to deal with. He explained things so I understand them fully.”

Ashoka P. 24-03-2023

The gentleman who visited me was professional, courteous and turned out to be completely trustworthy. I have to say that I was initially surprised at my assessment of this person, as debt collectors (mainly as a result of the work they have to do) do not enjoy the best of reputations, but my first assessment was justified by my subsequent interactions with this person.”

Laura P. 24-03-2023

“Sympathetic to your situation and understanding, makes you want to pay your debt”

Phil W. 10-03-2023

“Tai was excellent. Wasnt home when he called in. Wife said he was very polite and never felt any intimidation what so ever. Rang him soon as I got home, he even apologized for any concerns, we arranged a payment plan…glad he actually got hold of me. Cheers Phil“

Gordon C. 4-03-2023

“I was very surprised at how civil the chap I spoke with was, not only civil but allso friendly and understanding”

Tuaine N. 10-03-2023

“Cause they work around what you can afford, and once deal is done, they don’t bug you again unless you have missed payments, so in order to keep them away is pay the agreed payments. They are awesome”

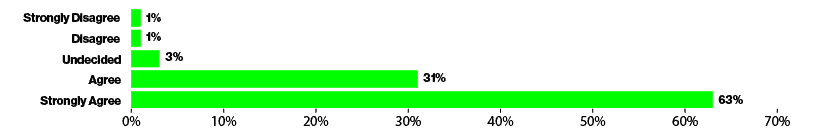

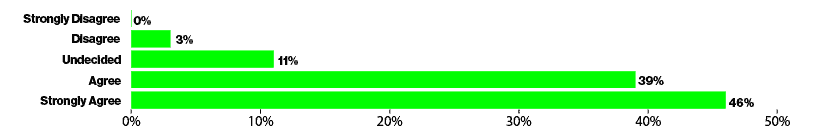

Some questions that we asked

I was treated fairly and provided a simple way to repay my debt

Paying back debt to DebtManagers has had a positive effect on my mental health

Holistically, better all around.

DebtManagers are the partner that enables companies to overcome all debt recovery challenges. It’s a total solution that replaces the frustrations of managing debt with reliability, expertise and regulatory assurance.

Better for customers

We rehabilitate those owing money so they’re brought back into the economy and back to your brand. An approach creating a fairer financial world for companies and customers.

Better for your brand

We ensure we meet and in many cases exceed CCCFA regulations. So companies can rest easy knowing we conscientiously work within regulatory guidelines and legal frame works.

Better day-to-day

We integrate seamlessly with your team’s processes by providing expertise and the latest technology. Integration that frees up staff to concentrate on other parts of your business.

Better financially

We deliver financial certainty for businesses because we buy a company’s bad debt in full. It delivers immediate cash realisation and our competitive pricing is based on market factors.

Questions?

What’s the advantage of selling our debt?

Will we lose control of our customers? What protections do we have around brand?

What is debt sale versus contingent debt collection?

Why don’t you do contingent debt collection?

How much is the debt worth?

We’ve never sold debt before, what is the process to complete? How long will it take?

What do you collect on the debt after we have sold them?

How can we help?

Like a little more detail about our services or have a specific question? Please fill in the online form and one of our team members will be in touch within 2 business days.

Please choose one of the following options:

Pay or discuss a debt you owe

Hours: Monday – Friday 8:00am – 8:00pm

Phone: 0800 683 738

Email: hello@debtmanagers.co.nz

Postal address

DebtManagers

Private Bag 92027

Victoria Street West

Auckland 1142

New Zealand